carried interest tax uk

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and. The trump reforms stopped short of taxing all carried interest as ordinary income and instead.

Capital Gains Tax Examples Low Incomes Tax Reform Group

If carry were treated as remuneration then it would be taxable as ordinary income at marginal federal rates ie.

. Amounts falling within one of the exemptions will remain within the capital gains tax CGT regime unless they fall to be treated as incomebased carried interest as described below. Taxing carried interest which is not regarded as trading income at a minimum rate of 28 per cent. The path was nearly cleared for one of the cornerstones of President Joe Bidens domestic agenda after Democrats agreed on a revised version of their tax and climate.

However the rate of CGT applicable to carried interest remains at 28 whereas a rate of 20 applies to most other types of capital gain. Carried interest also referred to as the carry which might entail 20 of the funds profits over a set period typically annual with the exception of private equity funds. Relief will only be available if the other tax paid is directly relatable to the carried interest amount received.

103KE of the Taxation of Chargeable Gains Act TCGA 1992 which prevents carried interest from being taxed twice is limited to UK taxes only. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Taxing carried interest which is not regarded as trading income at a minimum rate of 28 per cent.

Carried interest is wholly IBCI if the relevant fund holds its assets for an average of 3 years or less. Closing the carried interest loophole is likely to be one of the thorniest sticking points in moving the Inflation Reduction Act of 2022 forward. On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower rate of tax eg.

Tax by Practical Law Tax This note discusses the employment income tax National Insurance contributions and capital gains tax implications for individuals acquiring and receiving payments of carried interest in private equity funds. The debate focused on the issue of whether carried interest should be taxed as an investment or as remuneration for services. For example a percentage return on investor contributions to the fund a specific annual yield or the outperformance of an index.

The remaining 3430 of your wages 16000 minus 12570 reduces your starting rate for. James article was published in TheWealthNet 11 October 2021 and can. The idea that the people who provide the service of asset management who are often some of.

Carried interest now falls into one of two categories. The UK resident. Capital Gains Tax civil partners and spouses Self Assessment helpsheet HS281 Collection.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as. In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate of tax on their bonuses Head of the Incentives Group James Paull examines the carried interest debate. 3 Taxation of carried interest in the UK 23 By James McCredie and Alicia Thomas Macfarlanes LLP The underlying rules partnership taxation 26.

This is intended to ensure that individuals pay at least the full rate of Capital Gains Tax CGT on their economic gain from carried interest. Rate of 45 and 46 in Scotland and Class 4 NIC at a max. The Carried Interest Exemption Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying nature of those amounts at the fund level income tax at max.

Its usually tied to a specified rate of return known as profits over. HMRC made an update to the Investment Funds guidance on 19 January 2022 to indicate that tax in relation to s. Former US Treasury Secretary Lawrence Summers blasted the removal of a proposal to scale back the outrageous so-called carried-interest tax break from the Inflation Reduction Act in an interview on Bloomberg Televisions Wall Street Week with David Westin.

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI which is subject to capital gains tax CGT. As a capital gain.

Free Practical Law trial To access this resource sign up for a free trial of Practical Law. Legislation was published in the Summer Finance. And that planning tools -.

Current law Current law on the taxation of carried interest within sections 103KA to 103KH Taxation of Chargeable Gains Act TCGA 1992 was introduced by section 43 of Finance No2 Act 2015 with. Capital gains tax treatment of carried interest. Its only created when the fund generates profits.

Carried interest isnt guaranteed. Under a funds governing documents carried interest will be payable as a percentage share of the funds profits to the extent that the fund performance exceeds a specified hurdle or preferred return. Taxation of Carried Interest Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a.

Carried interest is received by a UK resident company. Others argue that it is consistent with the tax treatment of other entrepreneurial income. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain.

Current tax treatment of carried interest in Germany 45 Carried interest vehicle 46 International. Some view this tax preference as an unfair market-distorting loophole.

220v 110v Nail Fan Acrylic Uv Gel Dryer Machine In 2022 Gel Uv Gel Dryer Machine

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

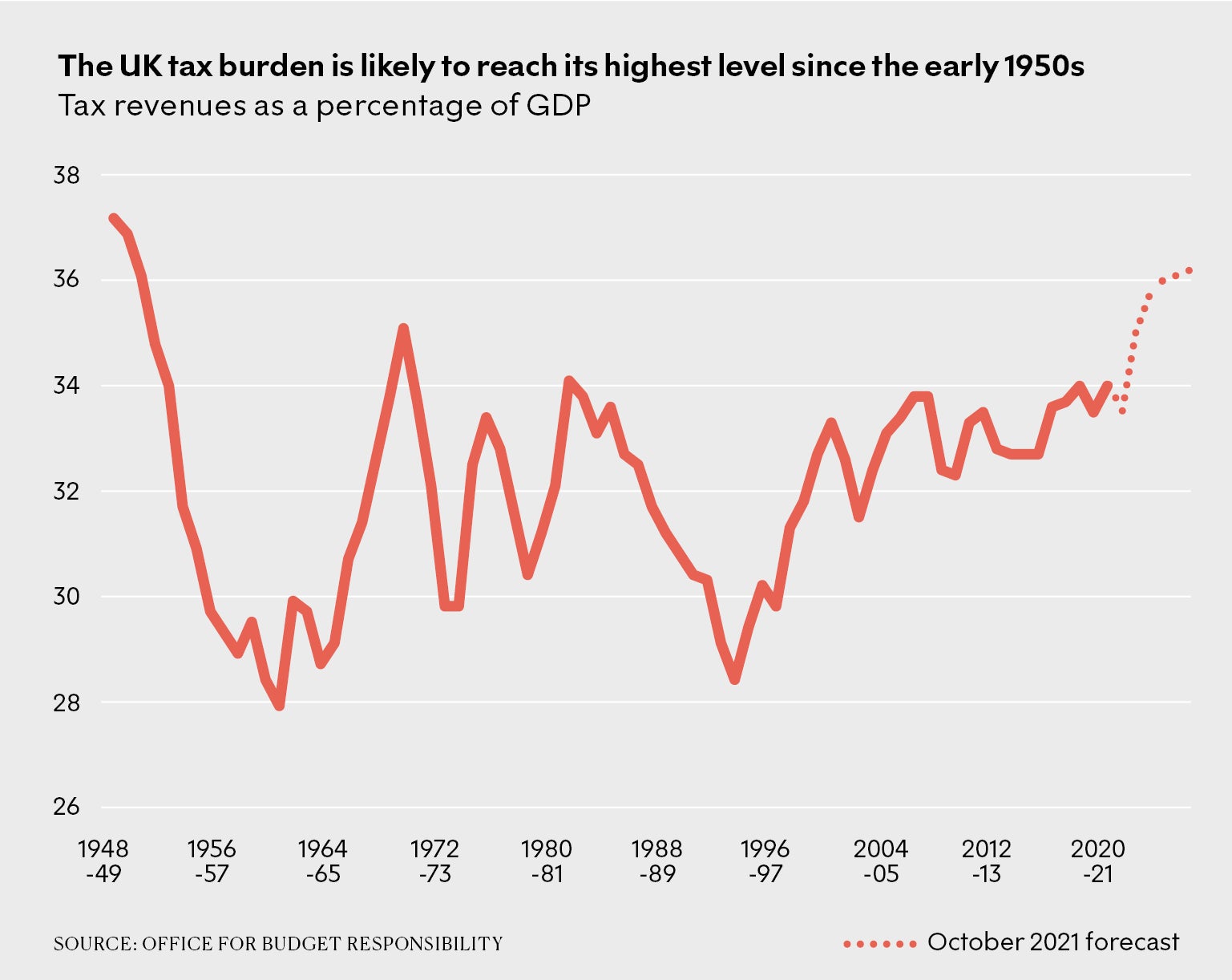

The Rise Of High Tax Britain New Statesman

Tax Relief Statistics December 2021 Gov Uk

Taxes On Money Transferred From Overseas In The Uk Dns Accountants Money Transfer Paying Taxes Blog Taxes

Tax Relief Statistics December 2021 Gov Uk

What Is A Cd Certificate Of Deposit Napkin Finance Has The Answer

How Does Carried Interest Work Napkin Finance

Pin On Money Saving Frugal Debt Free Budgeting

Taking Goods Temporarily Out Of The Uk How To Apply Understanding United Kingdom

Learn The Tips For Reducing Inheritance Tax Liabilities At Http Www Harleystreetaccountants Co Uk Top Five Tips For Reducing Inheritance Tax Liabilities

Basics Of Corporate Interest Restriction Understand The Cir Bdo

Uk Residential Property Structures What Are My Options

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group